Basic Business French 9:

Financial Reporting 2(s)

© 2015, Greg Lessard

About this module

In this module we will learn some of the basics of detailed financial reporting in French. The principles are essentially the same as those used for accounting in English, so if you know how that works, you have an advantage. But even if you don't, we will go through this at a basic level. You should also be aware that this module is not designed to teach you accounting. Its goal is just to show you how to read basic accounting documents in French. By the end of the module, you should be able to:

- read and understand a simple balance sheet

- read and understand a simple income statement

- understand some of the basic terms used in accounting statements in French (and English)

- apply this knowledge to the interpretation of basic financial statements.

The goals of financial reporting

In the Dickens' novel David Copperfield, one of the characters, Mr Micawber, gives his recipe for happiness:

Annual income twenty pounds, annual expenditure nineteen [pounds] nineteen [shillings] and six [pence], result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought [shillings] and six [pence], result misery.

We have added in square brackets some information about the currency, but the basic principle is clear: if one earns more than one spends, this is good, but if one spends more than one earns, this is bad. This principle of a balancing act is what underlies the core of accounting statements: we are trying to determine the relation between the positive and negative for some entity (an individual, a company, a government, etc.). The concept was first codified in the 15th Century in Italy under the concept of double entry bookkeeping. For example, if I spend $60 to purchase a coat, my cash on hand goes down by $60, but my inventory of possessions goes up by $60, since I now have a coat. For more basic information, see the Wikipedia entry on double entry bookkeeping.

In modern accounting, this reporting has been divided into sub-elements, so that a typical accounting statement produced by a firm at the end of a year will be composed of a number of things, including:

- a financial overview, as we saw in the last module

- a balance sheet

- an income statement

- a statement of retained earnings

- a statement of cash flows

- explanatory notes.

We will begin by looking at two of these: the balance sheet and the income statement. To help put these terms and concepts in perspective, we will begin with a simple case study. The goal of that is double: first, to show you the French terms you should learn, as well as their English equivalents, and second to help you understand the concepts behind these terms. N.B. this will not turn you into an expert in accounting. In fact, it is likely that you will not understand everything on a first read, but persevere, because it is not sufficient to learn the French words; you must understand as well how the concepts they carry all fit together.

The story of a lemonade stand

After graduation, Micheline was in search of employment. Not finding anything to her taste, but possessing some culinary skills, she decided to open up a lemonade stand. Her parents invested $500 in the business in exchange for a 25% share, and she put in $500 of her savings. Her brother made her an interest-free loan of $500 which she was to repay within three years.

With this money, she purchased a small block of land for $750 and a booth, blender and small refrigerator for $350. She also ordered organic lemons, organic honey and filtered water for $350.

With these things, she opened up shop. Her lemonade was very good and by the end of the year she had earned $600, of which she kept $45 on hand. She used the rest ($555) to purchase more supplies. At the end of the year, she owed $15 to her suppliers, and several corporate customers owed her $205 in total. She also had $150 in lemons, honey and water left.

It was now time to take a snapshot of where she was, so she made a un bilan (a balance sheet).

The balance sheet

| Citronnade Micheline |

This is the name of the company. |

| Bilan au 31 décembre 2015 |

This is the date that the balance sheet describes. |

| En dollars canadiens |

This is the currency used. Sometimes, values are in thousands or even millions of dollars. |

| 1 |

Actif |

These are the company's assets, that is, the cash and other things it possesses. |

| 2 |

Liquidités |

95$ |

This is the company's cash on hand. |

| 3 |

Débiteurs |

205$ |

These are the accounts receivable: what is owed to the company for products purchased. |

| 4 |

Stocks |

150$ |

This is the inventory: things the company has produced but not yet sold. |

| 5 |

Immobilisations corporelles |

350$ |

This is the plant and equipment that the company owns. |

| 6 |

Terrain |

750$ |

This is the land that the company owns. |

| 7 |

Actif total |

1550$ |

This is the total assets (2+3+4+5+6). |

| 8 |

Passif |

These are the company's liabilities, that is, what it owes. |

| 9 |

Créditeurs |

15$ |

These are the accounts payable, money owed at the end of the exercise for goods or services purchased. |

| 10 |

Effets à payer |

500$ |

These are the notes payable, like loans needing to be repaid. |

| 11 |

Total des dettes |

515$ |

This is the total of what a company owes. Called total liabilities, it is the sum of 9 and 10. |

| 12 |

Capitaux propres |

This is the shareholders' equity, that is, the difference between assets and liabilities (7-11). |

| 13 |

Capital d'apport |

1000$ |

This is the contributed capital, that is, amounts invested in the firm by shareholders or owners. |

| 14 |

Bénéfices non répartis |

35$ |

These are the retained earnings, that is, income earned over the years not distributed as dividends. |

| 15 |

Total des capitaux propres |

1035$ |

This is the total of contributed capital and retained earnings (13+14). |

| 16 |

Total des dettes et des capitaux propres |

1550$ |

This is the total of total liabilities, contributed capital and retained earnings (11+15). To 'balance the books', it should be equal to total assets (7). |

You should now reread the balance sheet and check the math to see how all the parts fit together. (A note in passing: this balance sheet does not contain two frequently-used items: interest on borrowing, because the loan from her brother was interest-free, and depreciation (in French, l'amortissement), an accounting for the fact that equipment wears out over time and this diminished value represents a loss.

The income statement

In light of the balance sheet, Micheline concluded that she had $35 more than when she started. Not a lot, but a start. But she needed more data, so the decided to do an état des résultats (an income statement). This measures the difference between revenues and expenses over some period, with the difference being expressed as le bénéfice net (net income). A positive net income means that one has taken in more than one has lost, whereas a negative net income means that one has spent more than one has earned. Let's look at Micheline's income statement now.

| Citronnade Micheline |

This is the name of the company. |

| État des résultats pour la période du 1er janvier au 31 décembre 2015 |

This is the period that the income statement describes. |

| En dollars canadiens |

This is the currency used. Sometimes, values are in thousands of dollars. |

| 1 |

Produit |

This is the company's revenue, that is, the amounts received for goods and services provided by the firm. |

| 2 |

Produit des ventes |

805$ |

This is the company's sales revenue: money earned for selling products. In the case of Micheline, all her revenue comes from sales. She has been paid $600 and she is owed $205 |

| 3 |

Revenu total |

805$ |

This is the total income. In this case, it is equal to the value of item 2. |

| 4 |

Charges |

These are the company's expenses, that is, what it had to spend to earn revenue. It includes things like raw materials, labour and so on. |

| 5 |

Salaire |

0$ |

This is the labour cost. Here it is $0, since Micheline did not pay herself for her work. |

| 6 |

Coût des produits vendus |

770$ |

This is the cost of goods sold. It is equal to the initial inventory, plus the cost of producing new inventory, minus the final unsold inventory. Here, it is equal to the cost of purchasing lemons, honey and water over the year: $350 initially, then later $555 more, and finally $15 still owed to suppliers at the end of the year. From this must be subtracted the $150 in inventory she still has on hand. |

| 7 |

Total des charges |

770$ |

This is the total of what a company has paid. Called total expenses, it is equal here to the sum of items 5 and 6. |

| 8 |

Revenu avant impôt |

35$ |

This is the pretax income, before income taxes are paid. It is equal to line 3 minus line 7. Here this gives $805-$770 = $35. If this amount was negative, it would be put in parentheses. |

| 9 |

Impôts |

0$ |

This is the income tax. It is 0 here because Micheline didn't earn enough. |

| 10 |

Bénéfice net |

35$ |

This is the net income, that is, excess of revenues over expenses over a period. If this were negative, would be called une perte nette (a net loss). |

We can see that the income statement provides a valuable complement to the balance sheet. Even though Micheline had money on hand at the end of the year, she did not earn very much. Leaving aside her investments in property and equipment, we can see that she spent $770 to earn $805. So she needs to find a way to make her business more profitable, either by raising prices or lowering costs. (As an exercise, think about what you would do in her case.) It is important to note also that she herself has not been paid in this model. Long-term, she needs to factor that in.

A quiz on accounting terms

In the first part of this module, we looked at a case study. It provided us with some basic concepts, but also with some terms that you should have learned. To check your understanding, take the following quiz. In each question, you will be shown a French term. You should type the English equivalent of the part in bold. For example, if you see un bilan, then you should type balance sheet.

The purpose of this quiz is diagnostic: to help you see how much you have retained. Since there are more questions in the quiz bank than are shown in each time the quiz is taken, it is useful to take it several times.

A note as well to students with background in accounting: the equivalents proposed here are not the only English translations. You may know others.

An extract from a balance sheet

So far, we have been working with simplified examples. However, it is useful for you to have a taste of what real accounting documents look like.

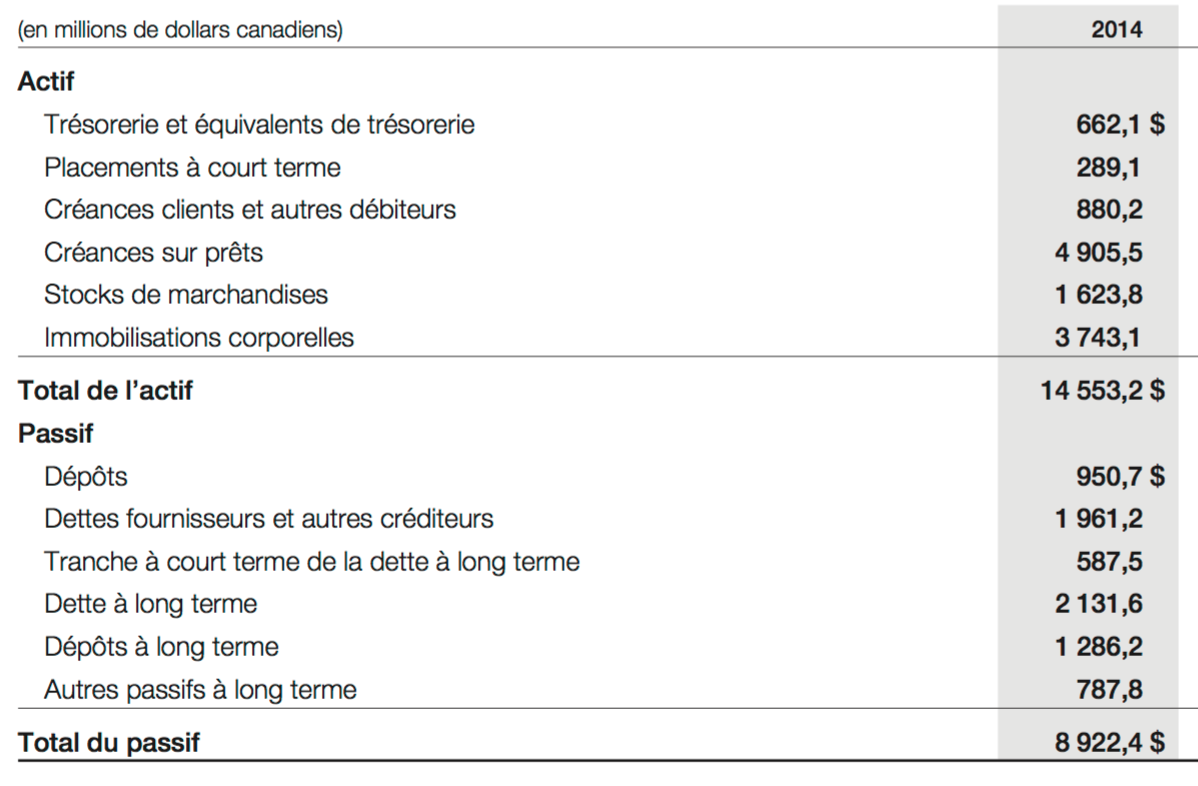

The first document we will look at is a consolidated balance sheet for Canadian Tire Corporation, which sells hardware, auto and other products. This snapshot was taken from the Canadian Tire Financial Reports site. Using the terminology and concepts you have learned, try to identify the concepts shown in the extract. Use them to answer the comprehension questions below.

To help you with answering these questions, here are some translations:

| French term |

English equivalent |

| Trésorerie |

Cash |

| Placements |

Investments |

| Créances |

Receivables: money owed to the firm. |

| Immobilisations corporelles |

Property and equipment |

| Dépôts |

Deposits: for example, when a customer makes a deposit toward a future purchase. |

| Dettes fournisseurs |

Trade and other payables: money owed to suppliers and others. |

Comprehension questions

- What dollar amounts are these categories stated in?

Answer

In millions of Canadian dollars (en millions de dollars canadiens).

- What is the largest category of assets?

Answer

Debts owed by customers who have borrowed money on credit (Créances sur prêts).

- What are the total assets?

Answer

$14,553,200,000. (Remember, these values are expressed in millions of dollars, and in French, the comma functions as the equivalent of the decimal point.

- What is the biggest component of Canadian Tire's liabilities?

Answer

Its long term debt (Dette à long terme), in other words, debt that doesn't need to be repaid soon.

- How much does Canadian Tire owe to its suppliers and to other creditors?

Answer

$1,961,200,000 (Dettes fournisseurs et autres créditeurs).

- Does Canadian Tire have more assets or liabilities?

Answer

It has more assets ($14,553,200,000) than liabilities ($8,922,400,000). What does this say about the company?

Another balance sheet

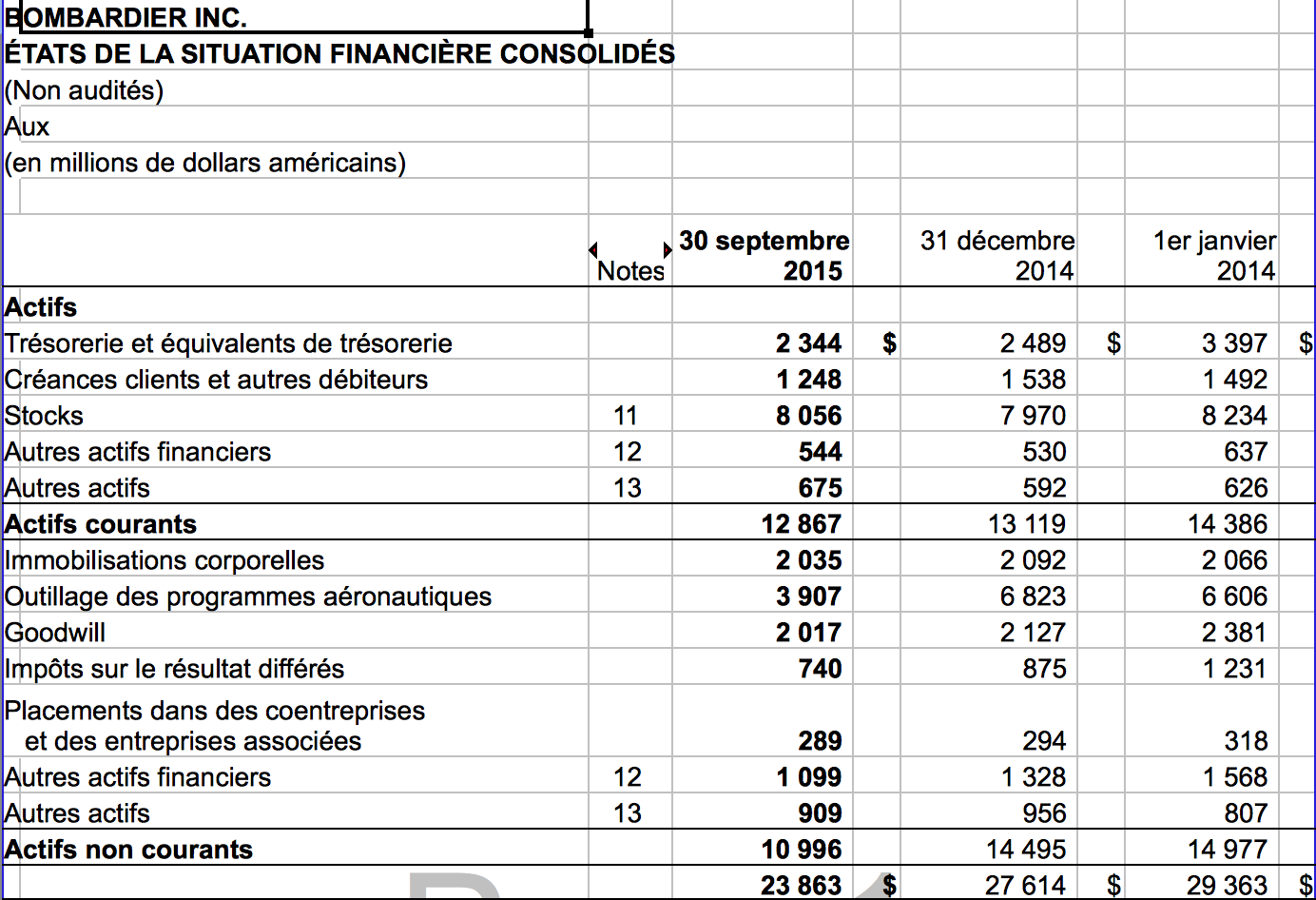

As a point of comparison, let us look at a recent balance sheet from Bombardier. In an earlier module, we saw that some shareholders had concerns. Let us see why. As in the last case, use your knowledge of accounting terms to decipher the relative values in the Bombardier document, drawn from the consolidated Bombardier site.

Several things should be noted about this example. You will see that it's an unaudited spreadsheet. Auditing is the process where certified external experts are brought in to verify that a company's records reflect accurately its true state of affairs. This is usually done at the end of a financial year, but here, since the results are for the third quarter of 2015 only, external auditing has not been done.

Note also that we have included here comparative data for previous years. This allows investors to compare a company's progress over time. There is also a column for Notes. In each case where more information is required, a note is written to provide this. Such notes appear at the end of a financial statement.

As before, here is a list of some terms you may not be familiar with, along with their equivalents in English.

| French term |

English equivalent |

| Trésorerie et équivalents de trésorerie |

Cash and cash equivalents: cash and short term investments that can quickly be redeemed. |

| Actifs courants |

Current assets: assets which are expected to be used up within a year, like inventory and cash. |

| Actifs non courants |

Non-current assets: those which are not expected to be used up within a year. |

| Immobilisations corporelles |

Property plant and equipment. |

| Outillage |

Machinery |

| Goodwill |

Goodwill: a measure of the difference between what a company has paid for some asset and the net identifiable value of the asset. So if an asset is worth $500 and $600 is spent to acquire it, the goodwill would be $100. Sometimes called la survaleur in French). |

| Impôts différés |

Deferred income taxes: taxes which are owed but not yet paid. |

| Placements dans des coentreprises et des entreprises associées |

Investments in joint ventures and associates. |

Now let us look at some comprehension questions to check your understanding.

Comprehension questions

- What dollar amounts are these categories stated in?

Answer

In millions of American dollars (en millions de dollars américains).

- What is the largest category of current assets?

Answer

Inventory (Stocks). In this case, unsold planes and trains and parts for them.

- What category of non-current assets has fallen the most since December 2014?

Answer

Outillage des programmes aéronautiques (Machinery and equipment for aeronautical programs), which fell from $6,823,000,000 in December 2014, to $3,907,000,000 in September 2015.

- How much money does the firm have on hand to pay income tax?

Answer

$740,000,000. Of course, these will be paid out when Bombardier pays its taxes.

Now let us turn our attention to the other side of Bombardier's balance sheet, its liabilities (passifs).

As before, here is a list of some terms you may not be familiar with, along with their equivalents in English.

| French term |

English equivalent |

| Avances |

Advances: money prepaid to the company for products it has not yet delivered. |

| Provisions |

Provisions: money committed to pay future bills. |

| Avantage de retraite |

Retirement benefits: money the company pays toward the pensions of its employees. |

| Attribuables aux détenteurs d'instruments de capitaux propres |

Attributable to holders of equity instruments: equity instruments are things like shares, which also give a right to vote on company policies at shareholder meetings. |

| Attribuables aux participations ne donnant pas le contrôle |

Attributable to non-controlling interests |

Let us consider some questions about this part of the balance sheet.

Comprehension questions

- What is the largest category of current liabilities?

Answer

Money owed to suppliers and other creditors (fournisseurs et autres créditeurs).

- What is the largest category of non-current liabilities?

Answer

Its long-term debt (Dette à long terme which has a value of $9,029,000,000).

- What is the situation with respect to voting shareholders (les détenteurs d'instruments de capitaux propres)?

Answer

The company shows a deficit of $3,675,000,000. Notice the parentheses around the figure.

- When comparing Canadian Tire and Bombardier, which has the largest percentage of current to non-current liabilities? (Note that in the case of Canadian Tire's balance sheet, you will need to do some math to add up the members of the two categories.)

Answer

Canadian Tire's current liabilities are Dépôts ($950,700,000), plus Dettes fournisseurs et autres créditeurs ($1,961,000,000), plus Tranche à court terme de la dette à long terme ($587,500,000) for a total of $3,499,200,000. Its long-term liabilities are its Dette à long terme ($2,131,600,000) plus its Dépôts à long terme ($1,286,200,000), plus other long-term liabilities ($787,800,000) for a total of $4,205,600,000). So its long-term liabilities are a bit larger than its short-term liabilities. In the case of Bombardier, its long-term liabilities (passifs non courants) are $15,732,000,000, while its current liabilities (passifs courants) are $11,791,000,000. So its long-term liabilities are relatively larger than those of Canadian Tire.

These examples show how understanding the terms and concepts used in financial reporting can provide a window into a company's state of affairs and future prospects. Remember though that we have just scratched the surface. As we noted earlier, the goal is not to turn you into an accountant, but rather to give you some basics of financial literacy to help read these sorts of documents.

Reading passage

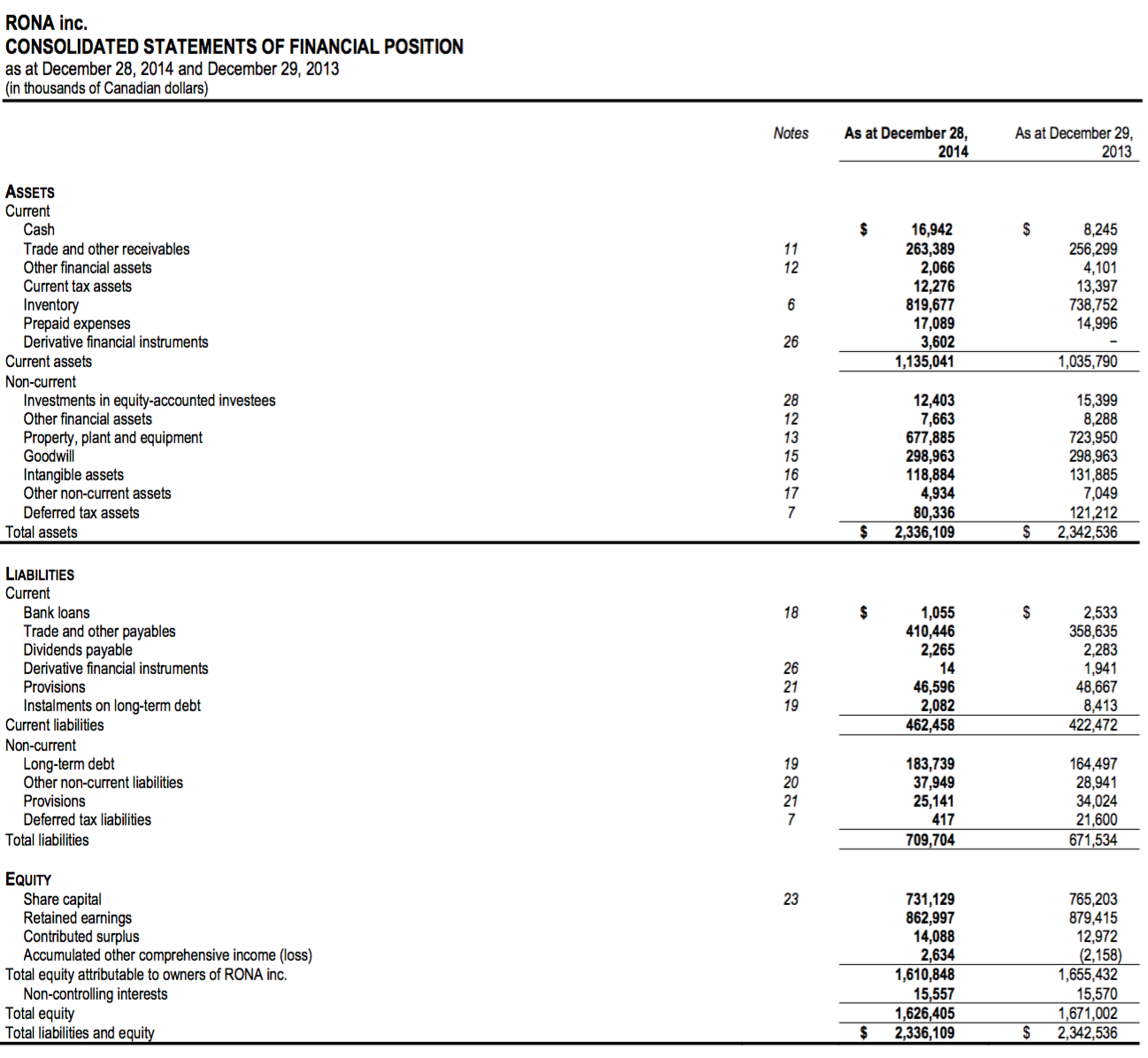

In this module, we have looked at some of the basic elements of financial reporting, paying particular attention to balance sheets. The following example provides another illustration of the same concept. It covers the activities of the Rona Group which sells building materials and hardware. The passage is drawn from the 2014 annual report (Etats financiers FR_16 février 2015 - Final-1.pdf). You will notice that it contains many of the terms that we have already seen. Identifying them will give you practice in dealing with this type of document.

As always, you should combine recognizing the terms with understanding the framework they work in: an overview of a company's state of affairs. As you did before, begin by reading the document below. If necessary, check any terms you do not understand against earlier parts of the module. Several additional explanations are provided below the document as well. When you feel comfortable, try to answer the comprehension questions below. A translation of the passage is also provided.

Some additional equivalents:

| French term |

English equivalent |

| Encaisse |

Cash. |

| Actifs d'impôt exigibles |

Current tax assets: money committed to pay future taxes. |

| Instruments financiers dérivés |

Derivative financial instruments: contracts made to provide insurance in case of risks. Derivatives are a very complex concept. |

| Placements dans des entreprises mises en équivalence |

Investments in equity-accounted investees: investments in other firms where the investing firm holds a significant interest. Values are calculated in light of this. Like derivatives, this is quite a complex topic. |

| Immobilisations incorporelles |

Intangible assets: things which are not physical, like intellectual property. |

| Emprunts bancaires |

Bank loans. |

| Versements sur la dette à long terme |

Installments on long-term debt: money spent to reduce the level of long-term debt. |

| Capital social |

Share capital: funds raised by issuing shares. |

| Surplus d'apport |

Contributed surplus: money earned from sources other than profits, like selling shares at higher than their nominal value. |

| Participations ne donnant pas le contrôle |

Non-controlling interests: shares owned by other than the parent corporation. |

Comprehension questions

- What dollar amounts are these statements expressed in?

Answer

In thousands of Canadian dollars (en milliers de dollars canadiens).

- What is the biggest element of current assets?

Answer

Inventory (stocks) with a value of $819,677,000.

- What is the value of property, plant and equipment at the end of 2014?

Answer

$677,885,000 (immobilisations corporelles).

- How much money does Rona owe to its suppliers and others at the end of 2014?

Answer

$410,446,000 (Fournisseurs et autres créditeurs).

- At the end of 2014, which is greater, Rona's assets or its liabilities?

Answer

Its assets (Total de l'actif = $2,336,109,000) are greater than its liabilities (Total du passif = $709,704,000). What does this say about the company?

Summing up

It should be clear that this module has dealt with some very complex questions. So you should not expect to have grasped everything. You should though feel somewhat comfortable with:

- basic balance sheets

- basic income statements

- the basic vocabulary used in accounting statements in French

- how to read and interpret simple financial statements, especially balance sheets.

Clearly, this will not make you an accountant, but it should give you the tools to make at least some sense of these sorts of documents. With this under our belts, we will now turn our attention to another major player in the world of business: banking.